excise tax nc formula

The excise tax is imposed on the manufacture sale or use of a certain commodity or the provision of a particular service. An excise tax is an indirect tax charged on the sale of a particular good.

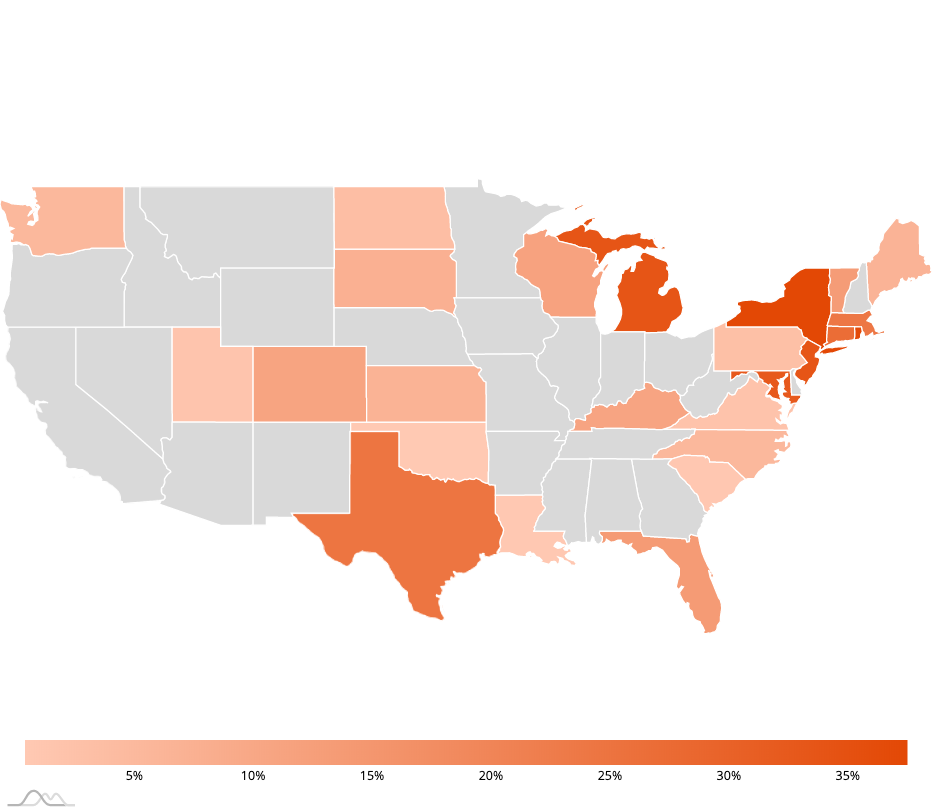

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

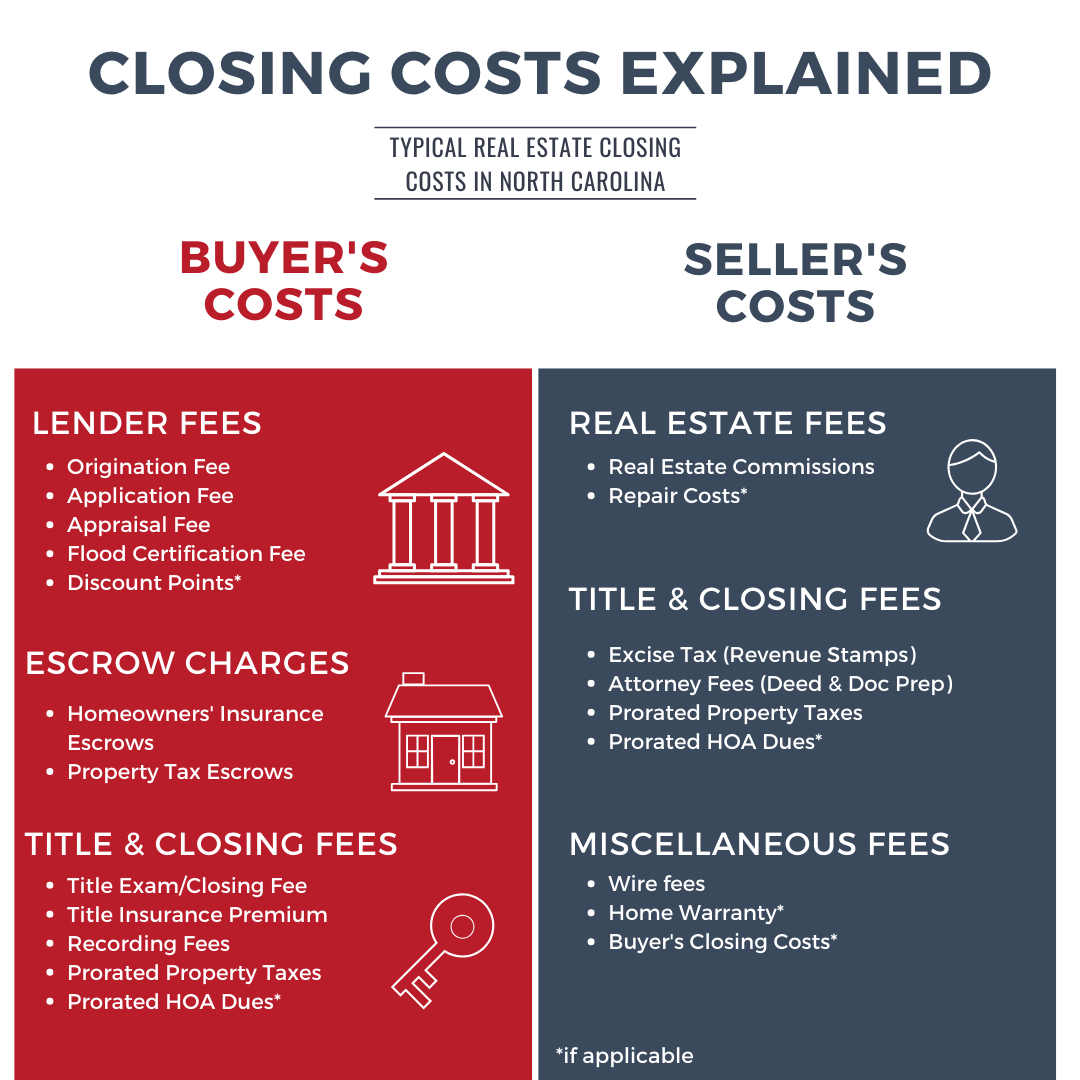

Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax.

. North Carolinas transfer tax rates are straightforward expect to pay 1 for every 500 of the sale price. Since excise taxes can be levied by the feds the state and the city they can add up certain items. The tax rate is one dollar 100 on each five hundred dollars 50000 or.

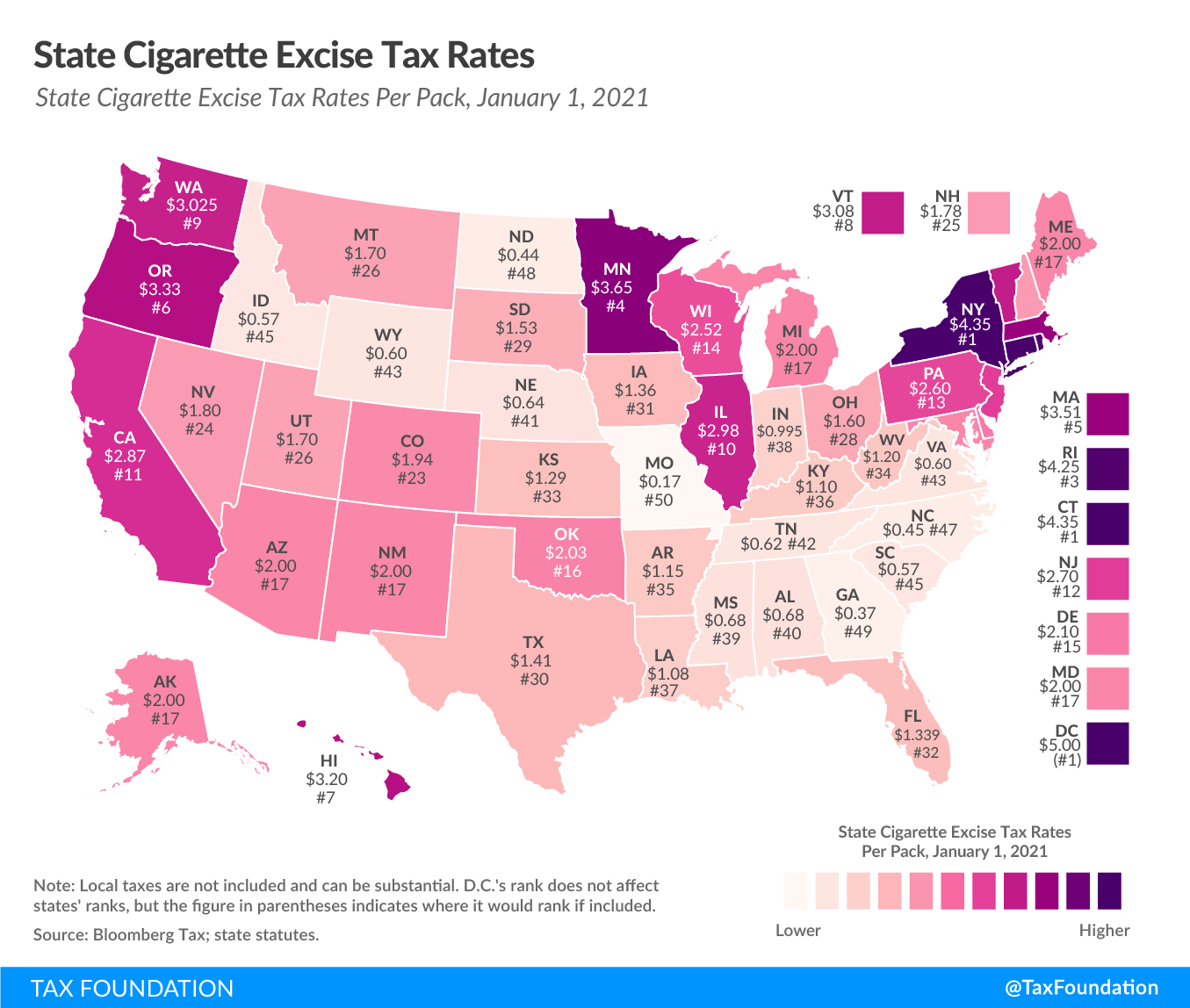

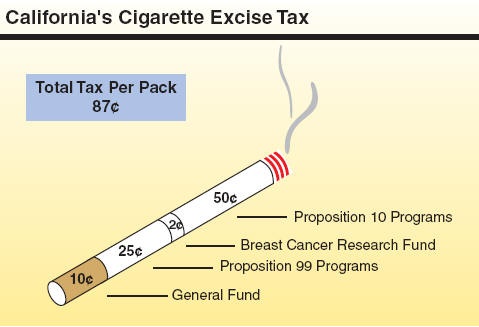

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. The tax rate is one dollar 100 on each five hundred dollars 50000 or. North Carolina Cigarette Tax - 045 pack.

The tax amount is based on the sale price of the home and varies by. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Returning to the District of Columbia local cigarette-specific excise taxes are 498 per pack of.

Beer Federal Tax Calculator. An excise tax is a tax on the transfer of ownership from the seller to the buyer paid at closing. Definition of Excise Tax.

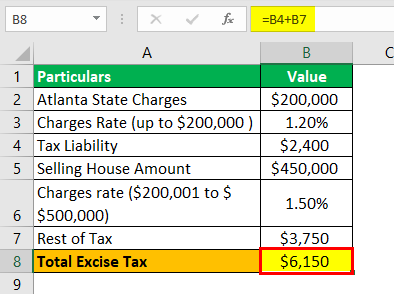

Since it is a specific excise tax the applicable formula is Tax Liability Quantity Tax per Unit. The price of spirituous liquor is determined by a mark-up formula as stated in GS. All spirituous liquor sold at retail in North Carolina ABC stores is priced uniformly throughout the state.

This title insurance calculator will also. The tax can be imposed and collected at the point of. How can we make this page better for you.

1 2020 Information Who Must Apply Cig License. So if you purchase a home or land for 900000 the revenue tax would be 900000 divided by 1000 and multiplied by 2 which. North Carolina Department of Revenue.

Customarily called excise tax or revenue stamps. 350barrel applies to the first 60000 barrels for a domestic brewer who produces less than 2 million barrels per year. Cigarettes are also subject to North Carolina sales tax of.

PO Box 25000 Raleigh NC 27640-0640. Federal tax department charges the firm an excise duty worth 3 per liter. The tax rate is 2 per 1000 of the sales price.

For the states average home value of 320291 the transfer tax would. Indirect means the tax is not directly paid by an individual consumer. Raw Retail Price Base Corrected Actual Retail Price Federal Specific Excise Tax State Specific Excise Tax x Ounces Sold128 Corrected Actual Retail Base Price x On- or Off.

In North Carolina cigarettes are subject to a state excise tax of 045 per pack of 20. The tax rate is 2 per 1000 of the sales price. Have you ever wondered how to calculate the revenue stamps excise tax on the sale of real estate in North Carolina.

Excise Tax Technical Bulletins.

Tax Guide 2009 State Publications I North Carolina Digital Collections

Excise Taxes Excise Tax Trends Tax Foundation

Calculation Of Minimum Cigarette Sale Prices Adapted From Michael J Download Scientific Diagram

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

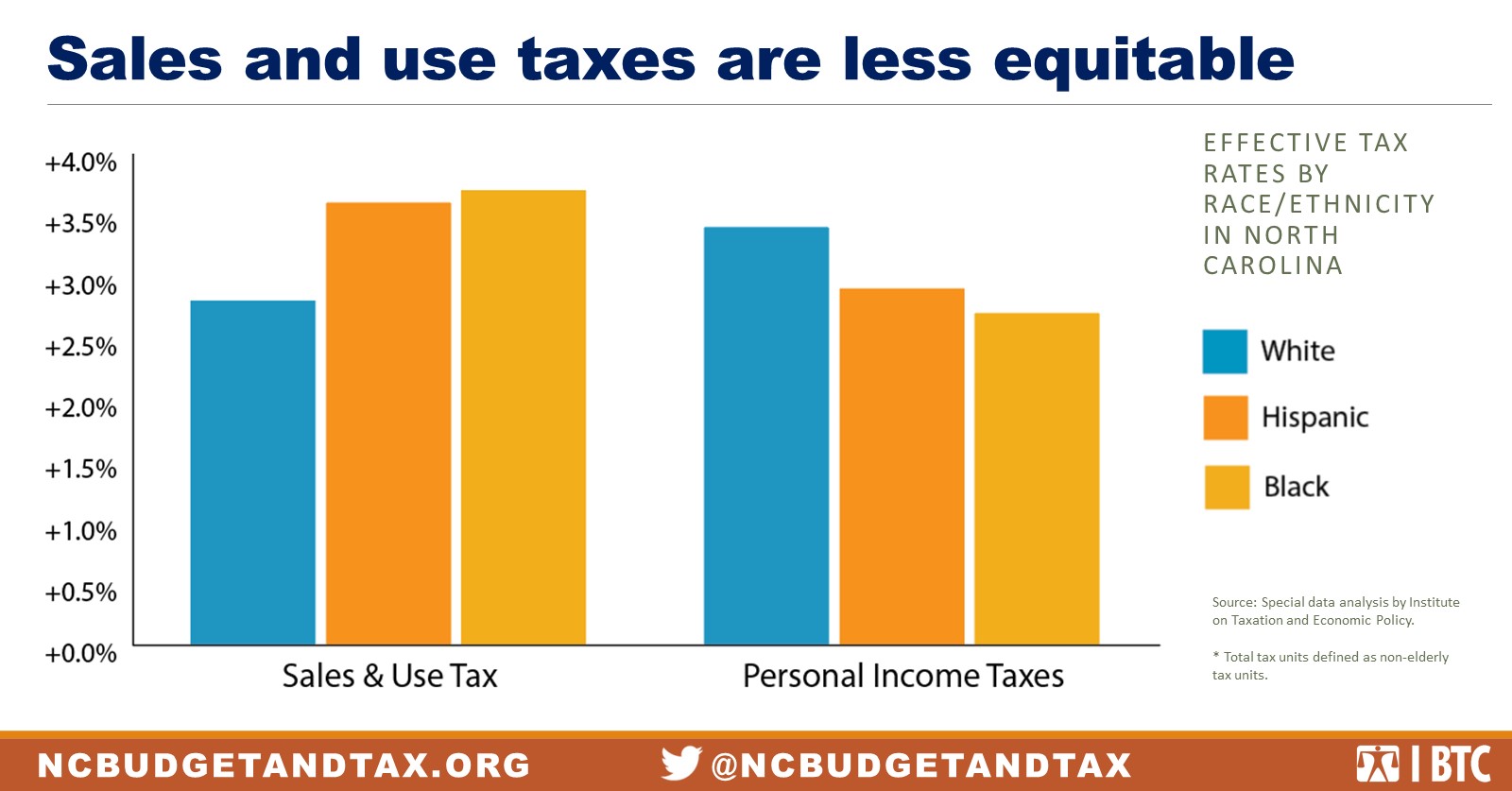

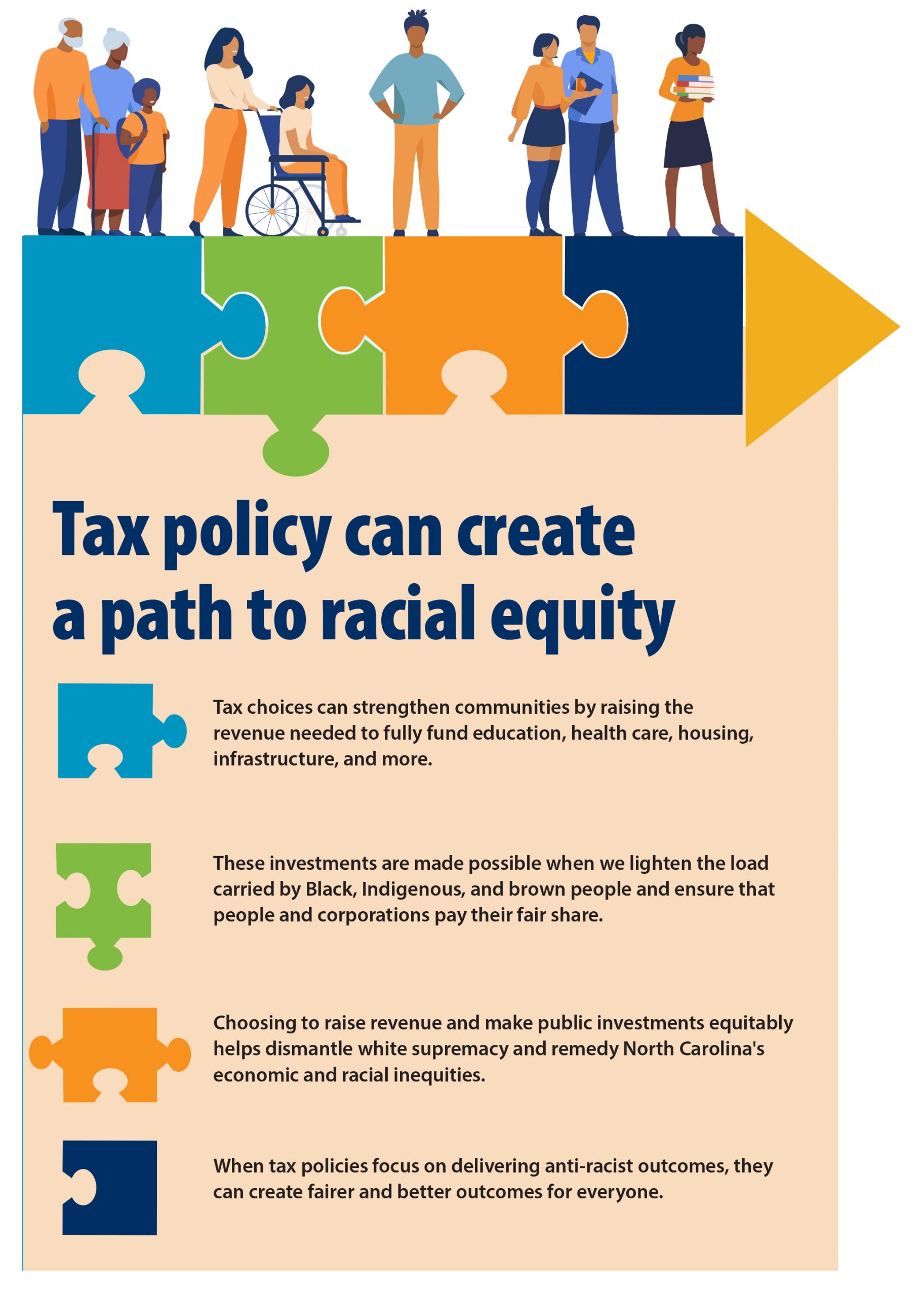

State Tax Policy Is Not Race Neutral North Carolina Justice Center

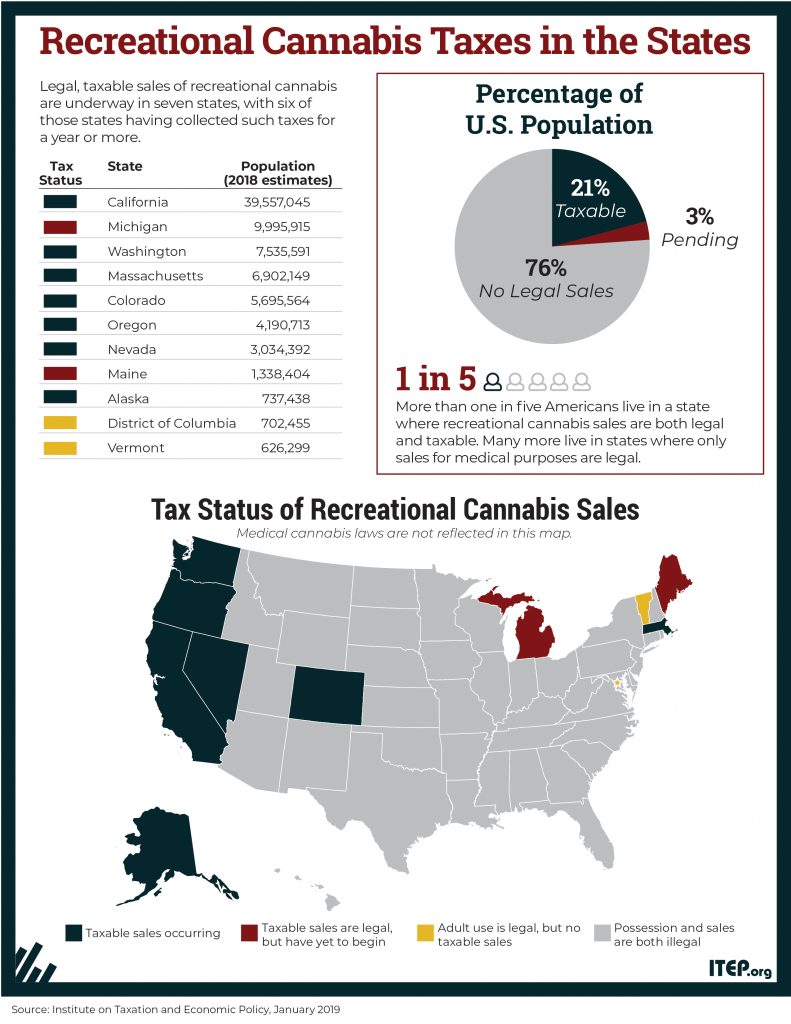

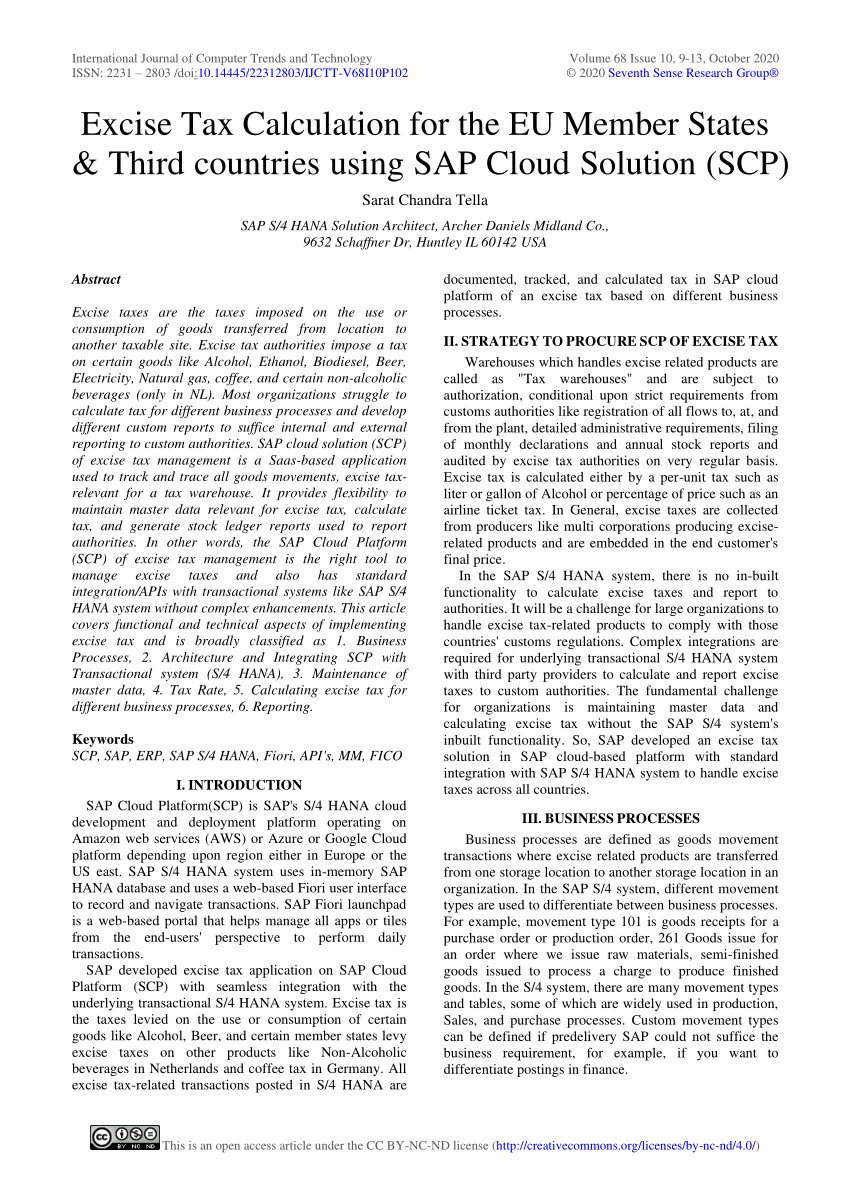

Pdf Excise Tax Calculation For The Eu Member States Third Countries Using Sap Cloud Solution Scp

How To Calculate Closing Costs On A Nc Home Real Estate

Excise Tax Definition Types Calculation Examples

Statistical Abstract Of North Carolina Taxes 2007 State Publications Ii North Carolina Digital Collections

Excise Tax In The United States Wikipedia

How To Calculate Tax Stamps In North Carolina

Do You Report Paid Excise Tax In Massachusetts

Excise Taxes Excise Tax Trends Tax Foundation

State Tax Policy Is Not Race Neutral North Carolina Justice Center

California S Tax System A Primer

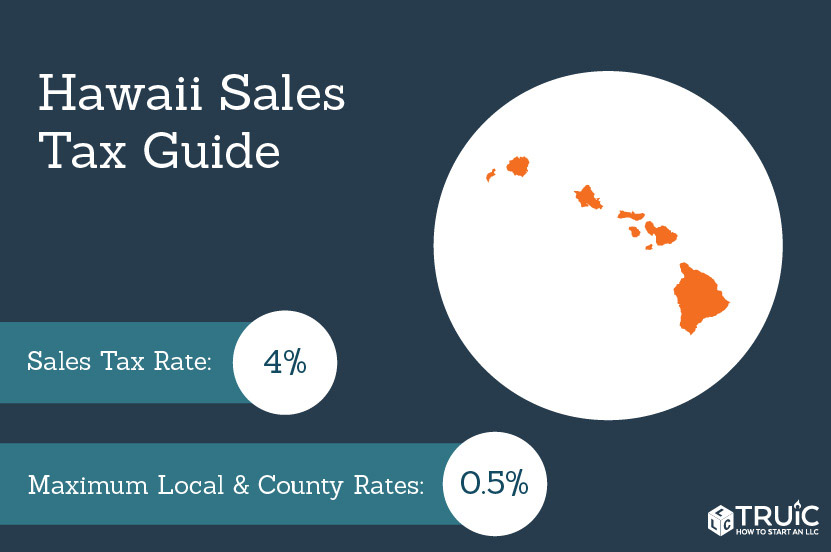

Hawaii General Excise Tax Small Business Guide Truic

How To Calculate Excise Tax Sapling

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations